Monero is uniquely immune to the Bubble

The collapse was triggered by Japanese yen carry trades

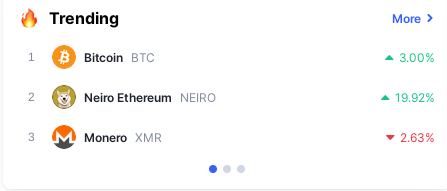

Front-page XMR

Today Monero is listed as a front-page trending coin on Coinmarketcap

But it isn’t rising that much ($148.81 from the low of $137), it’s just that it didn’t collapse with coins primarily traded on centralized exchanges. Monero’s attitude of “use it” over hodl & leverage keeps it stable.

Japanese Yen

And unique to this situation, as I’ve written about earlier, this entire collapse is triggered by Japanese yen carry trades. Monero’s history of being banned from the Japanese exchanges, makes it very few people long XMR/JPY on leverage.

Which in my opinion, makes it a great trade to decouple from banking liquidity, especially Japanese Banks. While Bitcoin being a BlackRock ETF allowing for institutional fiat leverage is less resistant against central bank actions.

Mind-set

The Bitcoin hodl’er says “My Bitcoin preserves value over time against inflation. I get more dollars years from now”

A Monero user says “Dollars are not relevant. Instead, I redefine our parallel shadow economy as legitimate. And you will not drag me down with your dying empire.”